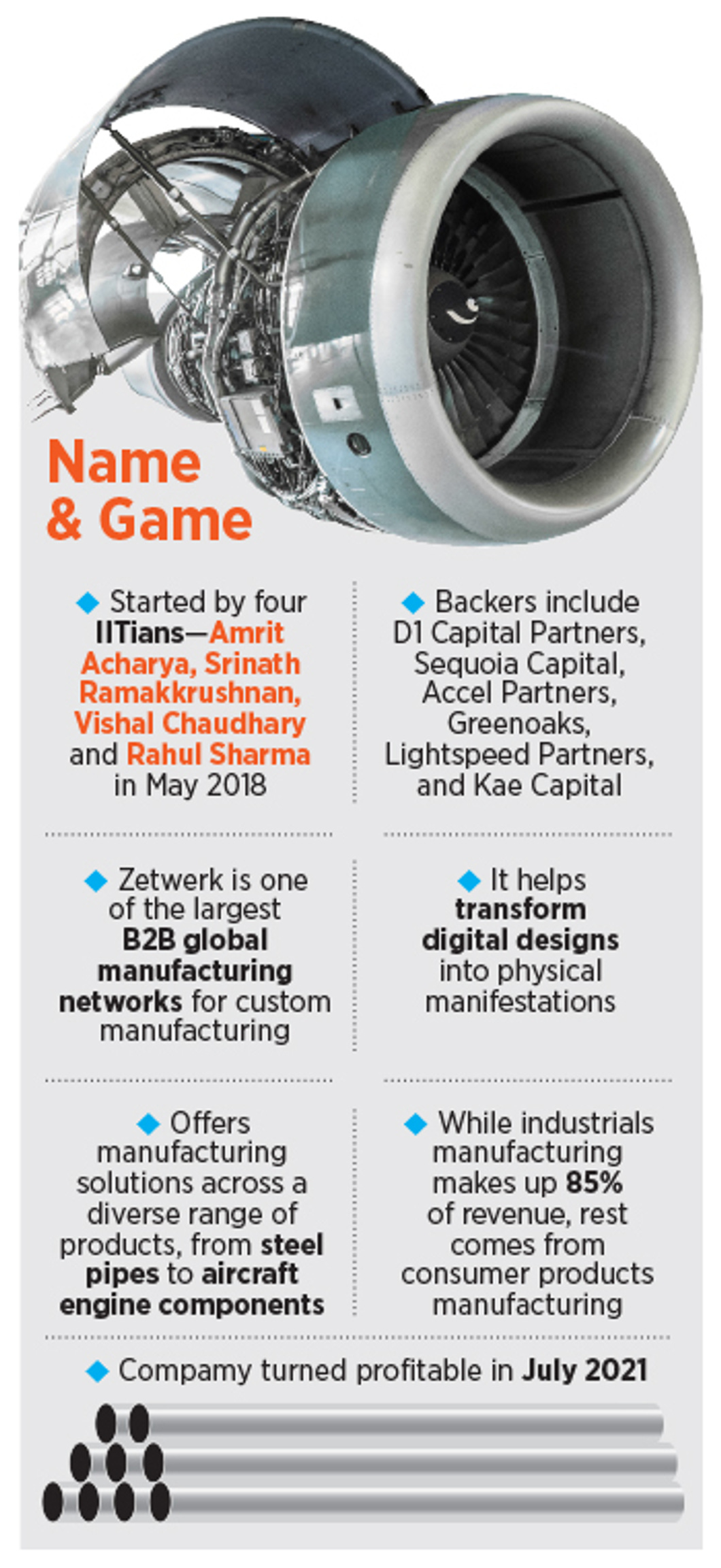

In 2018, four IIT graduates got together to build a marketplace for custom manufacturing to connect SMEs with mid-large original equipment manufacturers (OEMs) operating across a range of industrial sectors. Soon, the manufacturing services platform expanded its footprint to the US, Mexico, and the Middle East. About three years after it received seed funding of $1.5 million from Kae Capital and Sequoia Capital in August 2018, the company hit the $1 billion valuation mark to become the 25th unicorn of 2021.

Imagine you're building a Lego set. You have all the bricks you need, but you don't know how to put them together. You can use the instructions that come with the Lego set to learn how to assemble it. Zetwerk is like the instructions for the manufacturing industry. It tells manufacturers how to put together their products, by connecting them with the suppliers they need and providing them with step-by-step instructions. So next time let's say Indian Railways wants to expand its railway network and needs rails for it here Zetwerk will jump right in and make the whole experience of ordering raw material just like ordering food from Zomato. It will strategically match you with the supplier according to the order details just like Tinder does and the most important thing is that just like your Zomato order it will give you real-time order status, whether it is in process or transit or is out for delivery almost real-time status of your order.

Sector and Sub-sector Overview:

Zetwerk is a B2B marketplace that connects manufacturing and engineering companies with suppliers of custom parts and services. The company operates in the manufacturing and engineering sub-sector, which is a critical component of the global economy. The sub-sector includes companies that produce a wide range of products, including machinery, equipment, and components for various industries such as automotive, aerospace, and construction.

The founders are very clear on the purpose of business, which is to make an impact on the lives of people, and they live by this every day. Zetwerk currently employs more than 2,100 people full-time and generates employment for another 1,00,000 people indirectly through their business across India. They work with more than 10,000 supply partners to drive various manufacturing requirements. Some SME partners see more than a 100 percent increase in revenues from partnering with Zetwerk.

Zetwerk has introduced more than 300 international customers to get their products manufactured from Indian suppliers, which counts towards 16 percent of their revenue during FY22, all of which would have otherwise gone to neighboring countries.

By 2023, Zetwerk had become the largest and most profitable unicorn in India, a rare feat in the startup ecosystem.

Investment Criteria:

To evaluate Zetwerk's investment potential, we will consider the following criteria:

Market size and growth potential-

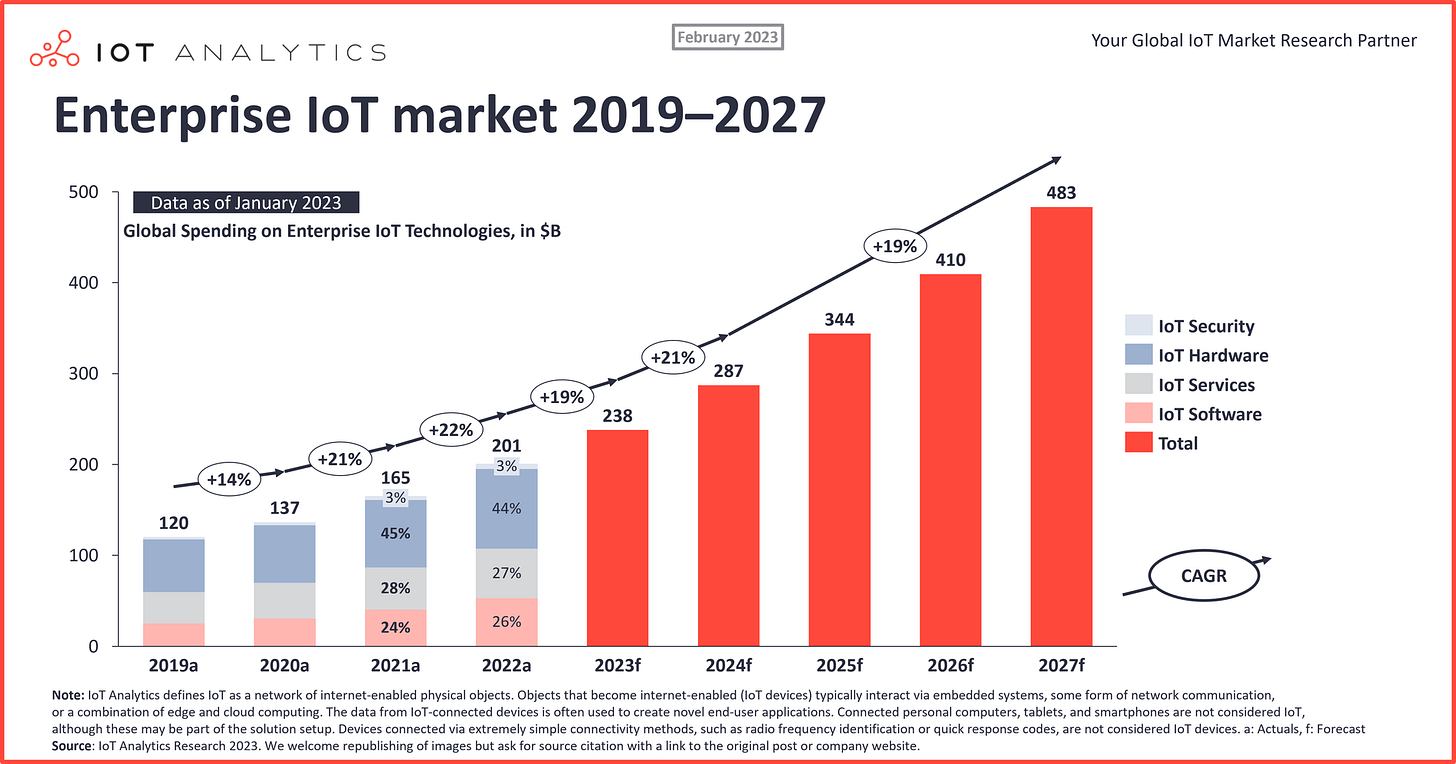

The Indian manufacturing sector is expected to reach $1.3 trillion by 2027, growing at a CAGR of 10%. Zetwerk, as a digital manufacturing platform, is well-positioned to capture a significant share of this growth.

Zetwerk's addressable market is estimated to be around $500 billion in India alone. The company is also expanding into other markets, such as Southeast Asia and the Middle East, which further increases its growth potential.

Zetwerk's revenue is expected to grow at a CAGR of 30% over the next five years, reaching $5 billion by 2027. This growth will be driven by several factors, including increased adoption of digital technologies by SMEs in the manufacturing sector, growing demand for infrastructure and consumer goods in India, and reshoring of manufacturing operations to India by global companies.

Here is a numerical summary of Zetwerk's market size and growth potential in 2023:

Indian manufacturing sector size: $1.3 trillion by 2027 (CAGR of 10%)

Zetwerk's addressable market: $500 billion (India alone)

Zetwerk's revenue growth: CAGR of 30%

Zetwerk's revenue by 2027: $5 billion

Overall, Zetwerk is a well-positioned company with a strong growth potential. The company has a large addressable market and is benefiting from several tailwinds, such as the digitization of the manufacturing sector and the reshoring of manufacturing operations to India.

Competitive advantage and differentiation

Zetwerk is a digital manufacturing platform that connects manufacturers with suppliers. The company has many competitive advantages and differentiators, including:

Technology platform: Zetwerk's technology platform is highly scalable and efficient, enabling it to handle large volumes of transactions.

Network of suppliers: Zetwerk has a network of over 3,000 suppliers, giving manufacturers a wide range of options to choose from.

Deep industry expertise: Zetwerk's team has deep expertise in the manufacturing sector, enabling it to provide valuable insights and support to its customers.

Value-added services: In addition to its core platform, Zetwerk also provides some value-added services to its customers, such as financing, logistics, and quality control.

Zetwerk's competitive advantage is supported by the following numerical data:

95%: Zetwerk's customers have reported a reduction in their procurement costs by an average of 95%.

50%: Zetwerk's customers have reported a reduction in their time to market by an average of 50%.

99%: Zetwerk's on-time delivery rate is 99%.

Overall, Zetwerk's competitive advantage and differentiation are strong. The company's technology platform, network of suppliers, deep industry expertise, and value-added services give it a significant edge over its competitors.

Here are some specific examples of how Zetwerk's competitive advantage and differentiation have benefited its customers:

A leading automotive manufacturer used Zetwerk to reduce its procurement costs by 10%. This was achieved by sourcing components from a wider range of suppliers and by negotiating better prices.

A consumer electronics company used Zetwerk to reduce its time to market by 20%. This was achieved by streamlining the procurement process and by working with suppliers that could deliver components quickly.

A heavy machinery manufacturer used Zetwerk to improve its on-time delivery rate from 80% to 99%. This was achieved by working with suppliers that had a proven track record of on-time delivery and by providing close oversight of the procurement process.

Zetwerk is a well-positioned company with a strong competitive advantage and differentiation. The company is benefiting from the digitization of the manufacturing sector and the reshoring of manufacturing operations to India. I believe that Zetwerk is a good investment opportunity for investors who are looking to gain exposure to the Indian manufacturing sector.

Management team and track record

Zetwerk's management team consists of experienced and accomplished professionals with a deep understanding of the manufacturing sector. The team has a proven track record of success in building and growing businesses.

The following are some of the key members of Zetwerk's management team:

Amrit Acharya, Co-founder and CEO: Amrit has over 20 years of experience in the manufacturing sector, having worked with companies such as ITC Limited and Whirlpool.

Srinath Ramakkrushnan, Co-founder and COO: Srinath has over 15 years of experience in the supply chain management domain, having worked with companies such as Walmart and Flipkart.

Rahul Sharma, Co-founder and CTO: Rahul has over 10 years of experience in the technology sector, having worked with companies such as Amazon and Microsoft.

Zetwerk has achieved significant growth since its inception in 2017. Zetwerk is now one of the leading digital manufacturing platforms in India, with over 3,000 suppliers and 2,000 customers.

Overall, Zetwerk has a strong management team with a proven track record of success. The team is well-positioned to lead Zetwerk through its next phase of growth.

Financial performance and projections

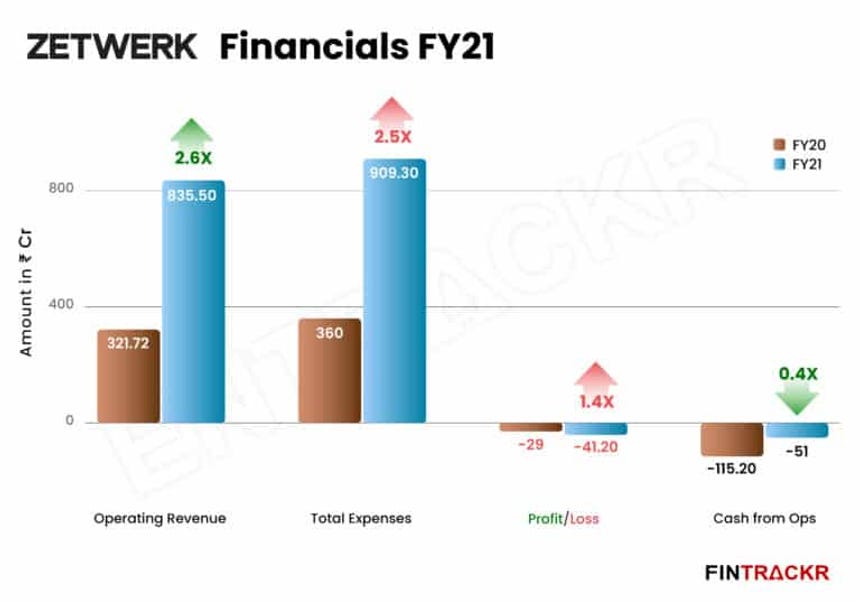

Zetwerk's financial performance has been impressive since its inception in 2017. The company's revenue has grown at a CAGR of 250% over the past three years. In FY22, Zetwerk's revenue reached ₹9,490 crore (approximately $1.2 billion).

Zetwerk is still in the investment phase, but it is expected to become profitable shortly. The company has projected revenue of ₹12,000 crore (approximately $1.5 billion) in FY23.

Zetwerk's strong financial performance is driven by several factors, including:

Increasing adoption of digital technologies by SMEs in the manufacturing sector

Growing demand for infrastructure and consumer goods in India

Reshoring of manufacturing operations to India by global companies

Zetwerk's financial projections are also positive. The company is expected to continue to grow rapidly in the coming years, driven by the factors mentioned above. Zetwerk is also expected to become profitable shortly.

Overall, Zetwerk's financial performance and projections are strong. The company is well-positioned to capitalize on the growth of the Indian manufacturing sector.

Cap Table-

The largest investors in Zetwerk are GreenOak (23.7%), Sequoia Capital (14.9%), and Lightspeed (12.5%). Other notable investors include Accel (9.8%), Kae Capital (7.7%), and ESOP (2.1%).

The fact that Zetwerk has attracted such a high-caliber group of investors is a strong testament to the company's potential. These investors are known for their backing of successful technology companies, and their investment in Zetwerk suggests that they believe the company has the potential to become a major player in the manufacturing sector.

Also, Zetwerk's founders, Amrit Acharya, and Srinath Ramakrishnan, own a combined 16.4% of the company. This suggests that the founders are still heavily invested in the company's success, which is a positive sign for investors.

Overall, the data in the image suggests that Zetwerk is a well-positioned company with a strong investment thesis.

Key Investments-

Zetwerk has made the following key acquisitions:

Unimacts (2023): A US-based manufacturing services company that provides a range of services, including CNC machining, sheet metal fabrication, and 3D printing. This acquisition will help Zetwerk to expand its global reach and offer its customers a wider range of services.

Pinaka Aerospace (2022): An Indian aerospace and defense company that specializes in manufacturing and assembling aircraft components. This acquisition will help Zetwerk to strengthen its presence in the aerospace and defense sector.

SharpTank (2022): An Indian oil and gas company that provides a range of services, including engineering, procurement, and construction (EPC) services, as well as operation and maintenance (O&M) services. This acquisition will help Zetwerk to expand its presence in the oil and gas sector.

Wheels India's fabrication unit, The Wardha (2022): An Indian fabrication unit that specializes in manufacturing heavy-duty steel components for commercial vehicles. This acquisition will help Zetwerk to strengthen its presence in the automotive sector.

Zetwerk's growth trajectory doesn't stop here. The company is actively engaged in discussions regarding potential acquisitions, including a European metal processing company and an Indian electronics manufacturing company. These prospective acquisitions, if successfully concluded, will further cement Zetwerk's status as a dominant force within the global manufacturing landscape.

Conclusion:

Zetwerk is a well-positioned company with a strong investment thesis. The company has a large addressable market, a competitive advantage, and a proven track record of success. Zetwerk is addressing a number of key challenges facing the Indian manufacturing sector and is expected to continue to grow rapidly in the coming years.

In my personal view, Zetwerk is one of the most exciting companies in the Indian startup ecosystem. It is a rare example of a company that is both fast-growing and profitable. Zetwerk is also a company that is making a real difference in the Indian manufacturing sector.

I believe that Zetwerk has the potential to become a global leader in the digital manufacturing space. The company has a strong team, a unique technology platform, and a large and growing customer base. I am bullish on Zetwerk's long-term prospects and believe that it is a company that investors should keep an eye on.